The Brazoria County MUD 36 (BCMUD 36) Board of Directors would like to inform residents on how property taxes are calculated in Texas.

Property market value: Estimated worth or price at which a property can be bought or sold in the Texas real estate market.

Property appraised value: Assessed or estimated value or a property, as determined by a professional property appraiser or by the local county appraisal district.

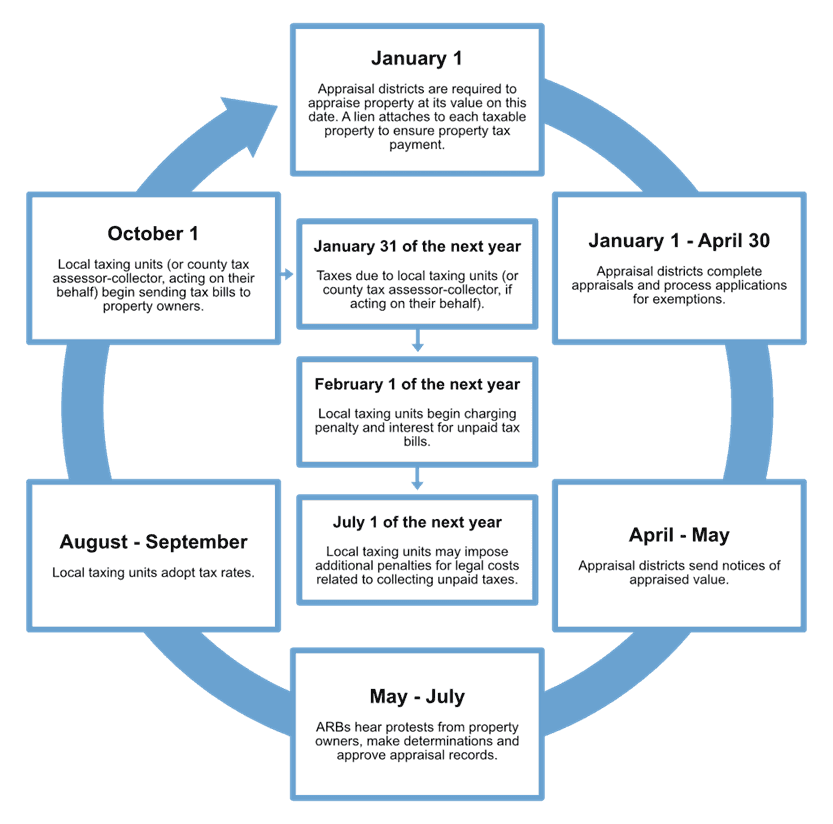

Your property's value is assessed each year on January 1st by the appraisal district and used to calculate your tax bill. Once the values are certified by the county appraisal district, the Board of Directors sets the tax rate for Brazoria County MUD 36 based on input from their financial consultants. Your tax bill is calculated by multiplying your property’s appraised value by the tax rate.

You can protest the value with the county appraisal district if you think it’s unfair or overvalued. Local entities set tax rates, and exemptions may apply. You should expect to receive your property tax bill in the mail by the end of October. You have until the end of January 31st of the next year to pay it without penalty.

Factors of Appraisal Price:

- Location of residence

- Condition of home

- Size of home

- Recent Sales of Similar Homes

Remember:

- Your property's value is assessed every January 1st.

- You can protest your appraised value if you think it is too high or low.

- Local entities set their own tax rates.

- There are a few exemptions that may apply to you.

- You have until the end of January to pay your property tax bill without penalty.

Tax Bill Formula: (Home Appraised value – Exemptions) Divided by 100. Then multiply the product by the tax rate = your bill. See video for example.

Watch this informational video produced by the Association of Water Board Directors (AWBD) to learn more.

For more information on appraisals, visit The Brazoria County Appraisal District Website.

Did you find this article helpful? Share with your friends and neighbors on Facebook, X/Twitter, and Nextdoor!